About Moonlite

One of the biggest challenges for an an environmentally-conscious cryptocurrency enthusiast is how to square enthusiasm for the technology with its environmental cost. Bitcoin and Ethereum mining both already use more energy than small countries. The exact numbers are a topic of some debate, but the bottom line is that proof-of-work cryptocurrencies are power-hungry.

This is something that anybody who's ever experimented with mining knows firsthand. Fire up some mining software on your own machine and listen to your fan hum (or just wait for your next electricity bill).

Electricity isn't inherently harmful to the environment, of course, and proof-of-work mining can be earth-friendly if it's powered with renewable energy rather than fossil fuels. But how can you mine crypto in an environmentally-friendly way if your local power plant isn't running on renewables?

Moonlite is a new cryptocurrency mining startup that will allow anyone to buy a stake in the mining of a variety of stable coins via Moonlite's ERC20 token (MNL).

After its upcoming ICO, the company plans to establish crypto-mining data centers in areas with low electricity costs and “clean and green” power plants. The first such center will likely be located in Iceland.

Investors will be able to buy into Moonlite via its MNL token, which is currently in pre-sale in the run-up to a late February ICO. Once the business is running, MNL token holders will be able to vote on how Moonlite distributes the revenue it generates from mining.

MNL token holders will be able to trade their tokens on public exchanges, but Moonlite is also offering a unique token buyback program on the Ether Delta exchange.

Every six months, holders will be able to sell their tokens back to Moonlite for the token's market price plus 35% of Moonlite's annual corporate profit. Tokens the company buys back will be “burned” – permanently destroyed – so that the number of MNL coins in circulation will drop steadily over time.

Mining Details

Initially, Moonlite will focus on mining Bitcoin and Litecoin. Using specialized mining rigs from Bitmain, Bit Fury, and Pin Idea, it will begin mining Bitcoin at a rate of 28,000 TH/s and Litecoin at a rate of 540,000 MH/s.

In its second phase, Moonlite will add DASH mining capabilities at 15,000 GH/s, and up its Bitcoin hash rate to 56,000 TH/s.

Its final planned phase will see capabilities increased again across the board: Bitcoin to 120,000 TH/s, DASH to 30,000 GH/s, and Litecoin to 1,008,000 MH/s.

To enable this power growth, Moonlite has built frequent equipment replacement into its business plan. This, the company says, will allow it to keep up and remain profitable as the mining difficulty increases across its target cryptocurrencies.

Moonlite may also mine Ethereum depending on its profitability, although Ethereum specifics aren't included in the company's three-phase mining plan.

The MoonLite Project will operate several industrial scale data centers in the Crypto-Currency Mining industry, and plans to begin by mining predominantly Bitcoin, DASH, Litecoin, and Ethereum using 100% sustainable, green energy.

100% of the energy we consume is generated using Hydro, Geo-Thermal, and Wind sources. The MoonLite Project will base its first mining operation in data center capital of the world, Iceland, where the average tariff for the industrial connections are 0.043 USD per kWh. Our data centers enjoy a contractual supply of the cleanest energy available, and at a multi-year fixed rate, and additionally do not need to provide extensive cooling infrastructure due to the cool Icelandic climate.

We have the best operational team to oversee and maintain effective operations of our data centers, and we have the most experienced and qualified board of advisers to assist in planning and executing a smooth launch. We are very selective of who we invite to be part of our team, and only engage with the best talent.

Our operations will combine a number of emergent technologies and systems such as Artificial Intelligence and custom sophisticated algorithms, that will work in synergy to maximize the profits and efficiency of large-scale cryptomining.

The proceeds from mining operations will be split as follows:

- Liquidating a percentage into fiat currency to cover operational costs, ad-hoc re-investment into operations, and to engage in other crypto & blockchain investment opportunities.

- Retaining a certain percentage of crypto-currency, to be kept in cold storage for the appreciation and investment value. A smaller percentage will also be traded by a highly experienced team of in-house crypto-traders to maximize returns.

- Retaining a certain percentage of crypto-currency to be used for planned equipment purchase and expansion.

- The ratio will be placed to a vote by token holders on a quarterly basis, but will begin with a 60:20:20 split. All voting will be executed by secure.vote, a decentralized blockchain governance voting system.

Operations are set to begin in August 2018, and we aim to be, in time, one of the larger crypto-mining companies globally.

Transparency and Security

Moonlite also aims to offer investors peace of mind about the legitimacy and security of its mining operations. Mining rewards will be quickly moved from hot wallets to cold wallets, and the keys to those cold wallets will be stored in a bank vault.

60% of the company's mining returns will also be liquidated into fiat currency and invested in more traditional investment products to ensure the company is less vulnerable to hacks or severe crypto market fluctuations.

Mining facilities will be secured with a variety of hardware and software solutions including fencing, CCTV surveillance, biometric access systems, dedicated security teams, and strong firewalls to prevent any unauthorized wired or wifi access to the mining network.

Moonlite also promising investors an impressive amount of transparency. It will update investors via social media and emailed newsletters, of course, but its whitepaper also promises that investors will enjoy “direct contant” to senior management “without delay.” Investors will even have opportunities to tour Moonlite's mining facilities in person once they're up and running.

Moonlight ICO Details

Moonlite will generate a total of 100 million MNL tokens, offering a maximum of 70 million to investors during the pre-sale and ICO.

Any unpurchased tokens from among those 70 million following the ICO will be permanently destroyed, decreasing the overall supply of MNL, and additional tokens will be destroyed every six months as part of Moonlite's token buy-back plan.

For the ICO, Moonlite has pegged MNL's value at 1 ETH to 500 MNL, which means that as of this writing, 1 $MNL costs about $2.10 in USD. However, Moonlite is currently in the first stage of its pre-sale, and is offering scaling token bonuses depending on contribution size and how early investors contribute. The minimum pre-sale buy-in is 0.1 ETH, but big spenders can get a bonus of up to 300% more tokens for their hard-earned money.

Interested parties can contribute in a variety of cryptocurrencies including Ethereum, Bitcoin, Litecoin, DASH, and Ripple, but the company's also accepting direct credit card contributions via VISA and MasterCard. MNL tokens will be sent to an ERC20 wallet address of the contributor's choice. And as is usual with ICOs, Americans can't participate.

TOKENOMICS

The project’s internal tokenomics are governed by its token buy-back program, likely the most fascinating aspect for readers of the white-paper.

The first token buy-back program will begin six months after completion of the full sale and only initial contributors will be invited to participate. Subsequent buy-backs will then proceed at regular six month intervals thereafter, six weeks after each half-yearly financial audit.

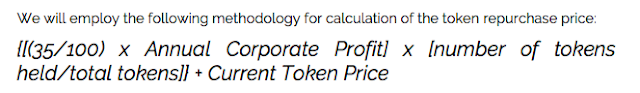

For the buy-back program itself, just over 1/3 of all net profits (35%) will be allocated to the re-purchase of tokens being sold on the open market. Where things get interesting is that these buy-backs will take the form of buy-orders placed on the exchanges at a price that sits above the current market average. Excerpt from the white-paper:

In other words, 35% of the operations profits will be conceptually distributed between each token currently circulating on the open market to determine a ‘mark-up’ figure. This mark-up figure is added to the current market price of the token to determine the value of the buy-orders placed by MoonLite on the exchanges.

Repurchased tokens will then be burned – i.e. removed from circulation permanently – thus reducing supply. The mechanics of the token buy-back are designed to result in a perpetual reduction mechanism of token circulation.

Whilst token buy-backs financed by operational profits are a regular feature of token issues, a buy-back program driven by a repurchase price which is itself determined by the operation’s profit margins is something entirely new to us here at ICOExaminer and will, at the very least, make for interesting observation on the overall price dynamics of the token.

Consideration

As with any ICO, the big question about Moonlite is whether it can deliver what it promises. The company boasts an experienced team and advisor board, heavy on cryptocurrency and management expertise but perhaps a little light on experience setting up international data centers. And while it has big plans for its high-tech data centers, its important to remember that at the moment that's all theoretical – the company has no operational mining centers yet, although it says it has already established relationships for the bulk purchase of industrial mining hardware.

Of course, that's the case with almost any ICO – you're buying into an idea and a team more than an existing product. Moonlite looks like it has a competent team, and the idea – giving everyday investors a way into mining cryptocurrency without destroying the planet – definitely seems worth pursuing. If the team can execute on what it has promised, Moonlite is yet another crypto that (sorry) could be headed for the moon.

Well, interested to join at Moonlite? If you need more information, please visit links below :

.

.

My profile :

ETH address :

0xA6460C4FF0A704E20148f18031d19AFA4aa0edF9

Komentar

Posting Komentar